The monumental fall from grace

The U.S. Government requested the Bahamian authorities to arrest Sam Bankman Fried (SBF) on December 12, 2022, based on a sealed indictment filed by the Southern District of New York.

The arrest comes just over a month after the shocking implosion of the centralized exchange, FTX, which was trusted with over $32 billion of clients’ assets. The International arm of the exchange offered clients 20X leverage trading.

The Bankruptcy & Hack. When a run on deposits started in early November, SBF reached out to Binance for a loan, which fell through shortly after Binance got a look under the hood. The Company filed for Chapter 11 Bankruptcy on November 11, 2022. Hours later, the exchange was “hacked” for $663 million. Blockchain analytics firms

reported

that $186 million went to FTX personnel, and the remaining $447 million were transferred to decentralized exchanges such as Uniswap. The day before the bankruptcy, the only people who could withdraw from the exchange were

Bahamas’ citizens

and a black market emerged for Bahamian passports.

New CEO’s testimony. SBF was scheduled to speak at the U.S. Congressional Hearings on December 13, 2022, which would have been pretty interesting considering the scathing

testimony from the new CEO of FTX, John Ray III. Mr. Ray was also the CEO post-Enron.

Questions have been raised as to why all of the FTX Group companies were included in the Chapter 11 filing, particularly FTX US. The answer is that FTX US was not operated independently of

FTX.com. Chapter 11 protection was necessary both to avoid a “run on the bank” at FTX US and to allow our team the time to identify and protect its assets. Since the time of the filing, I have become even more confident this was the correct decision, as the books and records issues at FTX US and the many relationships between FTX US and the other FTX Group companies become clearer.

Ray also noted:

- All US and International customer assets were commingled with the Alameda trading platform.

- Alameda engaged in risky margin trading activities and exposed customer assets to massive losses.

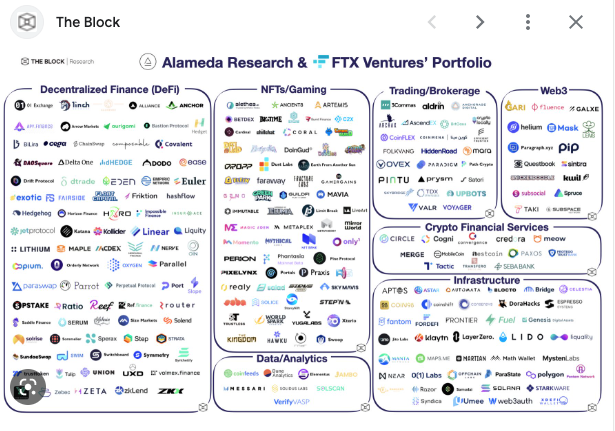

- The FTX Group invested over $5 billion into illiquid equity positions in a variety of overvalued and illiquid crypto start-ups during the height of the bull market.

- More than $1 billion worth of customer assets were used as loans and other payments to company insiders.

- Alameda deployed customer funds to various other unsafe crypto exchanges.

Press Circus. Without a major exchange to run, SBF has been spending all of his time the past few weeks doing podcasts and Twitter spaces with each interviewer trying to act like a prosecutor and coax him to admit to fraud. SBF maintained that he lacked the intent to harm any customers, and just didn’t realize that he was doing anything wrong.

Some interesting

quotes from his various interviews include,

- I own “close to nothing,” he told Andrew Sorkin of the NY Times, that he was down to his last $100,000.

- “The Vacation home was not intended to be my parents’ long-term property.” FTX bought $121 million worth of properties in the Bahamas according to Reuters, including a $19 million vacation home in his parents’ name.

- “I didn’t knowingly commingle client funds,” but on a twitter space, he said, “In general, balances were generally treated as effectively fungible with each other.”

- “It was a huge management failure and sloppy accounting.”

Investigations. The Bahamas’ government has frozen some FTX assets, and there are said to be investigations opened from Australia and Japan, as well as by the U.S. Securities & Exchange Commission (SEC) and the U.S. Department of Justice (DOJ)

High-Profile Lawyers. Meanwhile, SBF has had trouble keeping lawyers on staff.

Martin Flumenbaum resigned on November 18 citing a conflict of interest. Recently,

Mark S. Cohen has come on board, he is the lawyer who recently represented Ghislaine Maxwell and prosecuted El Chapo.

Wire fraud. The inner circle at FTX, SBF, Caroline Ellison, Nishad Singh, and Gary Wang, allegedly had a secret signal chat – ironically called “wire fraud.” The charges SBF will face likely include wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy, and money laundering. If each charge received the maximum penalty, SBF could be looking at 60 years in prison.

Clawbacks. It will take the bankruptcy proceedings many years to untangle the mess of fraudulent transfers, but ultimately every politician and media outlet that received millions of dollars in donations should be ready to return those funds to the bankruptcy estate.

Contagion. Since FTX’s fallout,

BlockFi was pushed into filing Chapter 11 in New Jersey on November 28, 2022. Likewise,

Genesis Trading, a company owned by Barry Silbert, closed its withdrawals on November 16, 2022. When the exchanges suggested they should all show proof of reserves to improve transparency and confidence in the industry,

Crypto.com accidentally transferred $320,000 Eth to Gate.io. It’s possible there will be more fallout in the coming months.

Class Action. Shortly after the bankruptcy filing, a class action case was filed against SBF, and numerous executives and celebrity endorsers. Recently the family attorney, Daniel S. Friedberg was added to the defendant list. Mr. Friedberg was instrumental in the online gambling world prior to shifting his practice to cryptocurrency exchanges. In a plot that could easily be featured on the Curb Your Enthusiasm show, Larry David was also named in the class action suit, even though he explicitly told people not to invest in FTX during the super bowl ad. Kevin O’Leary is also a defendant, for his role as a promoter of the exchange, for which he was paid $15 million.

Charges.

In the Southern District of New York (“SDNY”), SBF was charged with:

- Conspiracy to Commit Wire Fraud on Customers

- Wire Fraud on Customers

- Conspiracy to Commit Wire Fraud on Lenders

- Wire Fraud on Lenders

- Conspiracy to Commit Commodities Fraud

- Conspiracy to Commit Securities Fraud

- Conspiracy to Commit Money Laundering

- Conspiracy to Defraud the United States and Violate the Campaign Finance Laws

There is a forfeiture allegation stating all assets gained through any of the aforementioned fraud should be forfeited to the U.S. government.

In the SDNY, the SEC outlines the detailed fact pattern that led to the collapse. FTX did five equity fundraising rounds totaling $9.9 Billion, all based on promises to investors that appropriate risk management controls were in place.

Charges:

- Fraud in the Offer or Sale of Securities;

- Fraud in Connection with the Purchase or Sale of Securities

The prayer for relief includes:

- Pay disgorgement penalties of ill-gotten gains

- Civil monetary penalties

- Barred from ever acting as an Officer or Director of a public company

- Barred from ever participating in the issuance or purchase of any securities, or crypto-asset securities in the future

Charges:

- Fraud against all defendants (SBF, FTX, Alameda)

- Fraudulent misstatements of material fact and material omission against all defendants

Relief Sought

- A permanent injunction against violating the CFTC rules in the future

- Full restitution of client funds

- Civil monetary penalties

Conclusion . As the bankruptcy unfolds, the battle between the U.S. Government’s forfeiture claims and the depositors will hopefully land in favor of the depositors. Many are using this debacle as a chance to call for the industry to become subject to heightened regulatory scrutiny, but actually, we have existing rules against fraud, and it looks like those rules will be enforced after all.